Learn more about admission into these programs and explore how your Coursera work can be leveraged if accepted into a degree program at. Python and R are both powerful coding languages that have become popular for all types of financial modeling, including regression. This course is part of Gies College of Business’ suite of online programs, including the iMBA and iMSM. Excel remains a popular tool to conduct basic regression analysis in finance, however, there are many more advanced statistical tools that can be used. Excel remains a popular tool to conduct basic regression analysis in finance, however, there are many more advanced statistical tools that can be used.

#Regression excel how to#

This will be accomplished through use of Excel and using data sets from many different disciplines, allowing you to see the use of statistics in very diverse settings.

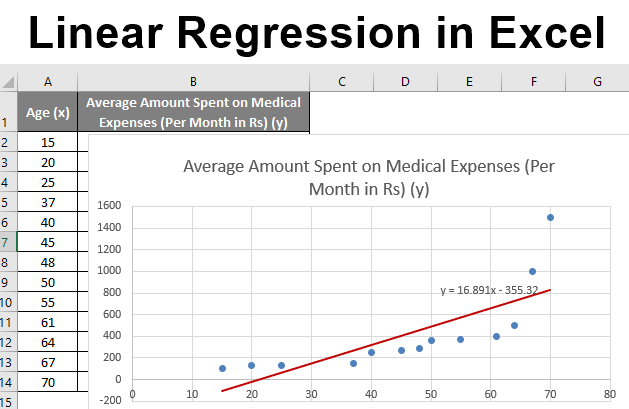

While you will be introduced to some of the science of what is being taught, the focus will be on applying the methodologies. Typically, I tell students that the two primary categories of basic statistics is whether they (a) determine the relationship. Now we know that the data set shown above has a slope of 165.4 and a y-intercept of -79.85. Our focus will be on interpreting the meaning of the results in a business and managerial setting. The fundamental concepts studied in this course will reappear in many other classes and business settings. Microsoft Excels regression limits to linear regression analysis however one can try to fit with one independent variable or multiple independent variables. To this end, the course aims to cover statistical ideas that apply to managers by discussing two basic themes: first, is recognizing and describing variations present in everything around us, and then modeling and making decisions in the presence of these variations. Im simple terms Regression is the process of determining the relationship between the dependent variable and a set of independent variables. This course provides an analytical framework to help you evaluate key problems in a structured fashion and will equip you with tools to better manage the uncertainties that pervade and complicate business processes.

0 kommentar(er)

0 kommentar(er)